- Verimi receives further funding in the double-digit million-euro range in the course of the financing round and thus has funding of over 100 million euros.

- A group of German insurers joins under the holding company of GDV Dienstleistungs-GmbH (GDV DL)

- The insurance companies and Volkswagen Financial Services are the lead investors in the financing round. Several shareholders increase their investment.

Berlin, 24 June 2021. Other well-known companies invest in Verimi to further promote the expansion of digital identity in Germany. In the course of the financing round, a group of well-known insurance companies under the holding company of GDV Dienstleistungs-GmbH (GDV DL) is participating. Together with Volkswagen Financial Services, they are leading the financing round, and other shareholders also increasing their investment. Verimi receives additional funds in the double-digit million-euro range in the course of the financing round and thus has total funding of over 100 million euros.

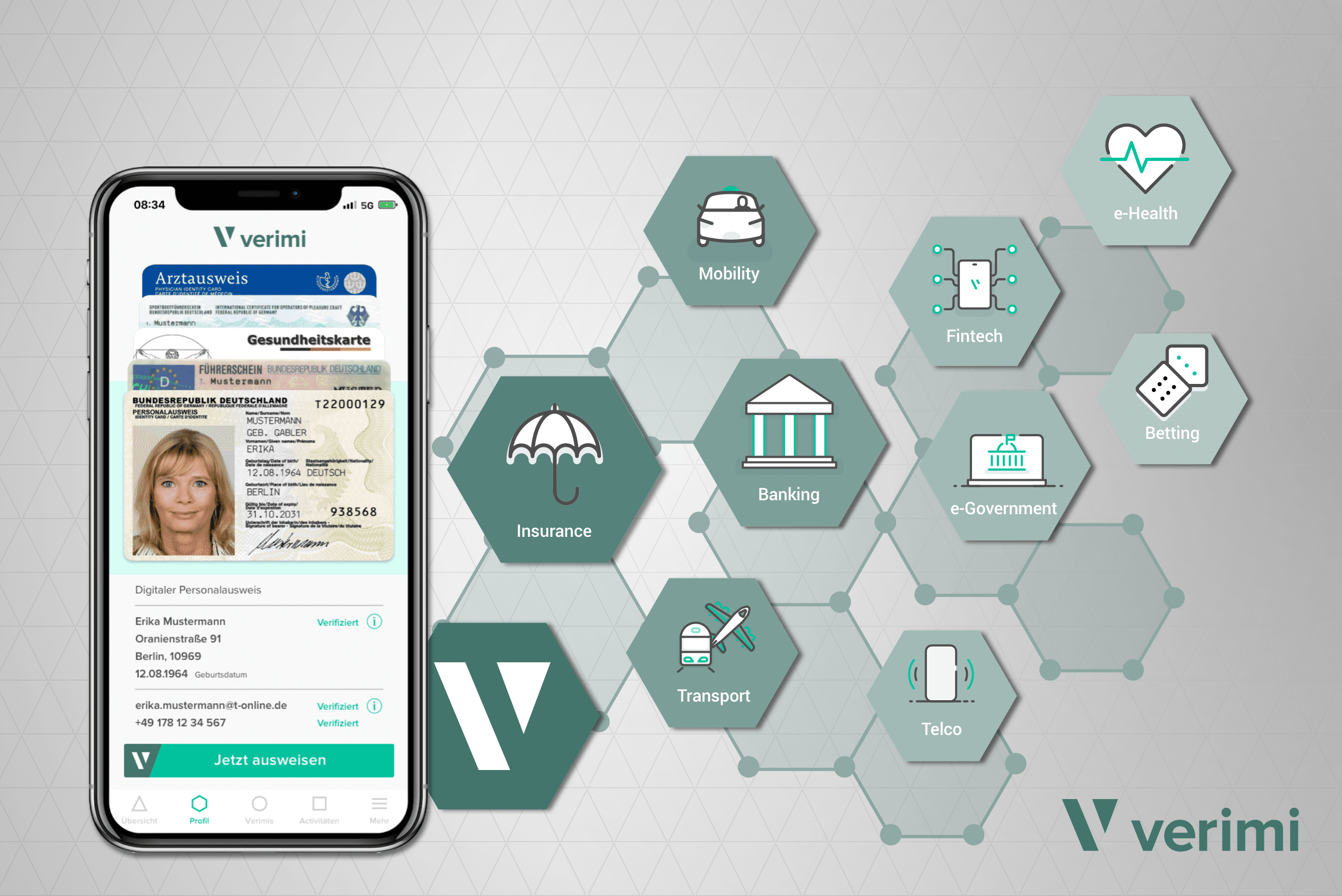

“The commitment of our investors underlines how important a widely accepted digital identity is for efficient business processes in banking, insurance, mobility, and telecommunications. The Verimi-Wallet for secure login, digital signing, payments and verified identity data has proven itself in many use cases in live operation. We are looking forward to the cooperation with the insurance industry and additional use cases for Verimi users,” says Roland Adrian, Managing Director and Spokesman of the Management Board of Verimi.

For the involvement, GDV DL establishes a new GmbH & Co. KG, whose limited partners are the insurance companies and GDV DL. The aim is to use Verimi’s services around digital identity and strong authentication as industry solutions for the insurance industry as well.

“In a digitalised world, secure and trustworthy identities are a mandatory requirement for government, business, and private identification processes. Suitable identification processes must not only demonstrate a high level of security, but also a high degree of user-friendliness. This is particularly evident in the Covid-19 pandemic, which highlights existing digitalisation gaps and at the same time drives the acceptance of digital processes. From the insurance industry’s point of view, the establishment of an open ecosystem for digital identities consisting of already existing ID providers and ID procedures with mutual recognition on the part of the state and the economy is essential. The insurance industry’s involvement in Verimi, bundled via GDV Dienstleistungs-GmbH, is an essential building block in this regard”. Quotation from Werner Schmidt, Chairman of the Supervisory Board of GDV DL, and Patric Fedlmeier, Chairman of the Business Administration and Information Technology Committee of GDV e.V. and Deputy Chairman of the Executive Board of Provinzial Holding AG.

“Verimi has built a unique platform and is an essential component in the digitalisation of our customer processes. Especially in onboarding and digital contracts with our customers, we realise efficiency leaps with Verimi and significantly increase the user-friendliness of our products. The investment in Verimi is, therefore, the logical continuation of our digitalisation strategy,” says Stefan Imme, CDO of Volkswagen Financial Services AG and Chairman of the Supervisory Board of Verimi GmbH.

Since its launch, Verimi has built up a comprehensive Wallet for digital identity and corresponding platform infrastructure, which basically can be used in the regulated areas according to AML, TKG, eIDAS, OZG and for the trust level “substantial”. More than 40 different use cases have been realised with partners in live operation for identification, authentication, payment, and digital signing via the web, app, and at the point of sale. Verimi will use the additional funds from the financing round to further expand its service portfolio and use cases. In addition, Verimi is preparing the usage of the Verimi ID Wallet for Self Souvereign Identity (SSI) use cases.

About Verimi

The Verimi-Wallet covers all functions related to digital identity: identification, login, payment, and signing – very simple, completely digital, and with the same user experience with all partners in public and private sectors. All common methods are used to save identity data initially digitally, e.g., eID, video, bank, photo, and on-site ident. Verimi offers particularly high security and data protection standards with data processing in Europe and integrating the secure local storage of the personal smartphone. The Verimi platform and two-factor authentication have been successfully tested by the German Federal Office for Information Security (BSI) at the trust level substantial. As a regulated payment institution, Verimi is obliged to comply with the Money Laundering Act (AML). The group of shareholders includes Allianz, Axel Springer, Bundesdruckerei, Core, Daimler, Deutsche Bahn, Deutsche Bank, Deutsche Lufthansa, Deutsche Telekom, Giesecke+Devrient, Here Technologies, Samsung, Volkswagen Financial Services and now newly added GMB Systems GmbH & Co. KG.

About GDV DL

GDV DL is a joint venture of the insurance industry. GDV DL is owned by more than 60 German insurance companies and GDV e.V. GDV DL provides cross-sector IT and specialist services for the insurance industry and operates its BSI-certified data centre as well as its service centre (24/7) for the insurance industry. With the Trusted German Insurance Cloud (TGIC), GDV DL provides a central hub for the secure standardised exchange of information and connects the insurance industry with its communication partners based on modern, secure cloud infrastructure. The insurance industry’s communication partners include not only partners in damage reporting/claims processing (such as workshops, towing companies, assistance service providers) and insurance intermediaries, but also public authorities (Federal Motor Transport Authority, supervisory authorities such as BaFin, German Pension Insurance) with whom GDV DL uses efficient standardised and highly secure applications and communication procedures.

Press contact Verimi

Mail: presse@verimi.com