- ID card, driver’s licence and COVID Certificate always at hand in the smartphone – securely stored in the personal digital wallet

- Verimi app eliminates the need to physically check IDs in everyday life, e.g. for 2G proof in gastronomy, for on-site checks or on the internet

- Highest data security through local protection, SSI principles and official approvals

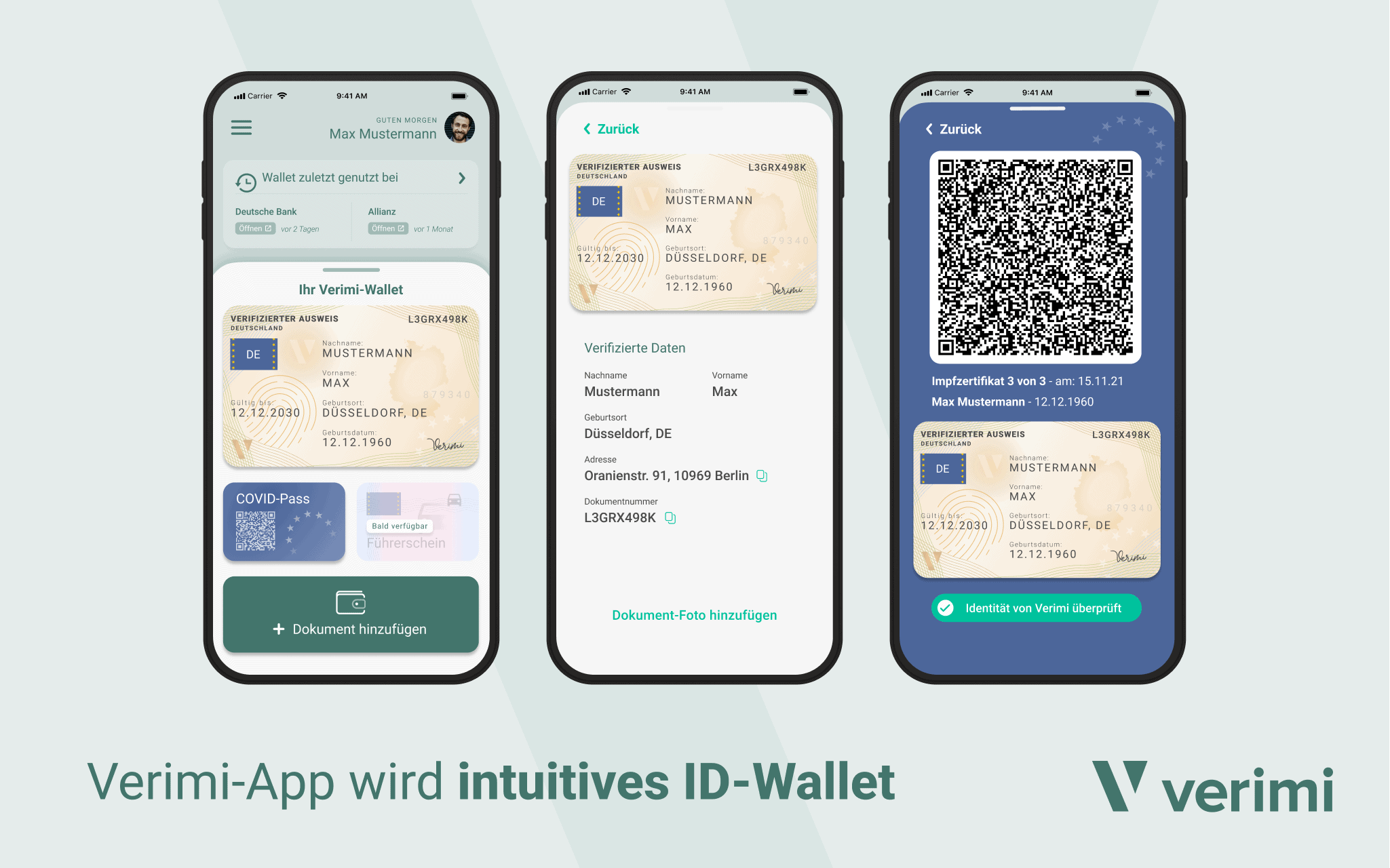

Berlin, February 14th, 2022. The Verimi app is evolving into an intuitive ID wallet for ID card, driver’s licence and EU COVID Certificates on the smartphone. Verimi is thus setting new standards for a user-friendly and everyday handling of official ID cards in the digital world. For visiting restaurants, bars, events and similar, the COVID Certificate and the verified ID are intuitively displayed on one page. In everyday life, it is therefore sufficient to simply show the screen of the Verimi app for the 2G proof. Even during digital onboarding, e.g. at banks, insurance companies or in mobility, users securely submit their credentials and ID data once stored in the Verimi app again and again with just a few clicks.

“Verimi brings digital identity into practice and simplifies everyday life,” says Roland Adrian, Managing Director of Verimi, “citizens finally have all their IDs and credentials verified and secure in one place on their smartphone to use them in all of their personal use cases – whether on-site as a ‘show-your-screen’ or in digital processes. For business and administration, this means a quantum leap in the efficiency of their processes.”

The Verimi ID Wallet is built on the principles of ‘self-sovereign identities’ (SSI), giving users full transparency and sovereignty over their data at all times. With this architecture, Verimi excludes unauthorised access, misuse, profiling or promotional use of personal data. Companies with high data security requirements, such as banks, insurance companies, telecommunication and mobility providers, as well as public administration, accept the Verimi ID Wallet thanks to its high standards of security and data protection, as well as its comprehensive certifications and approvals. Even the legally binding digital signature can be applied with the secure digital wallet with just a few clicks. Verimi Pay also offers convenient and secure payment services completely embedded in the use cases.

Users can access their Verimi Wallet via the web or in the app. With the Verimi app, ID data is secured locally on the smartphone and even changing the smartphone is easy without losing data. Citizens verify their ID data directly with Verimi using all common methods, hence without any other apps. Or they identify themselves with Verimi during their transactions with the connected partners. If desired, users can explicitly and self-determinedly confirm that the EU COVID Certificate matches their ID card data. The ID wallet and its use are of course free of charge for users. The first update is already available in app stores, with further additions to follow in the coming weeks.

About

The Verimi Wallet covers all functions related to digital identity: identification, login, payment and signature – easily, completely digital and with the same user experience at all partners in public and private sectors. To initially capture and verify identity data digitally, Verimi offers all common methods, e.g. photo, bank, eID, register, video and on-site ident. EU COVID certificates are automatically checked for authenticity and validity when added to the wallet. Verimi offers particularly high security and data protection standards with data processing in Europe and integrating the secure local storage of the personal smartphone. The architecture is built along the principles for self-sovereign identities (SSI). The Verimi platform and the two-factor authentication have been successfully tested by the German Federal Office for Information Security (BSI) at the trust level substantial. As a regulated payment institution, Verimi is obliged to comply with the Money Laundering Act (GwG). The group of shareholders includes Allianz, Axel Springer, Bundesdruckerei, Core, Deutsche Bahn, Deutsche Bank, Deutsche Lufthansa, Deutsche Telekom, Giesecke+Devrient, GMB Systems - a group of well-known insurers led by GDV DL, Here Technologies, Mercedes-Benz Group, Samsung and Volkswagen.

Press contact Verimi

Mail: presse@verimi.com