Verimi Bank-Ident: Identification via online banking

Your customers use their personal bank account to identify themselves digitally. Identification with Verimi Bank-Ident is carried out in compliance with money laundering legislation and know-your-customer requirements via the login into the online banking.

Convenient identity check for everyone - simply via online banking access

Offer your customers the opportunity to identify themselves conveniently and without any ID documents: just with their familiar online banking access. Identity verification is completely digital. With Verimi, your customers can also sign contracts digitally. Around the clock, legally valid and completely digital.

Your benefits at a glance

MLA-, eIDAS- and KYC-compliant

Fully automated online identification. For MLA in combination with a reference transfer and QES.

Around-the-clock identification

Your customers can identify themselves 24/7 and in just a few minutes using their bank account, regardless of opening hours.

Higher completion rates for your company

Identification with the online banking login without an ID document enables the best possible conversion figures.

Fully automated onboarding without agents

Innovative digital onboarding experience for your customers - independent of agents and physical ID documents.

Benefit from the Verimi Bank-Ident procedure

Watch the video to find out how you can increase your conversation rates and reduce your costs with the Verimi Bank-Ident process.

Identification in 3 steps - how it works

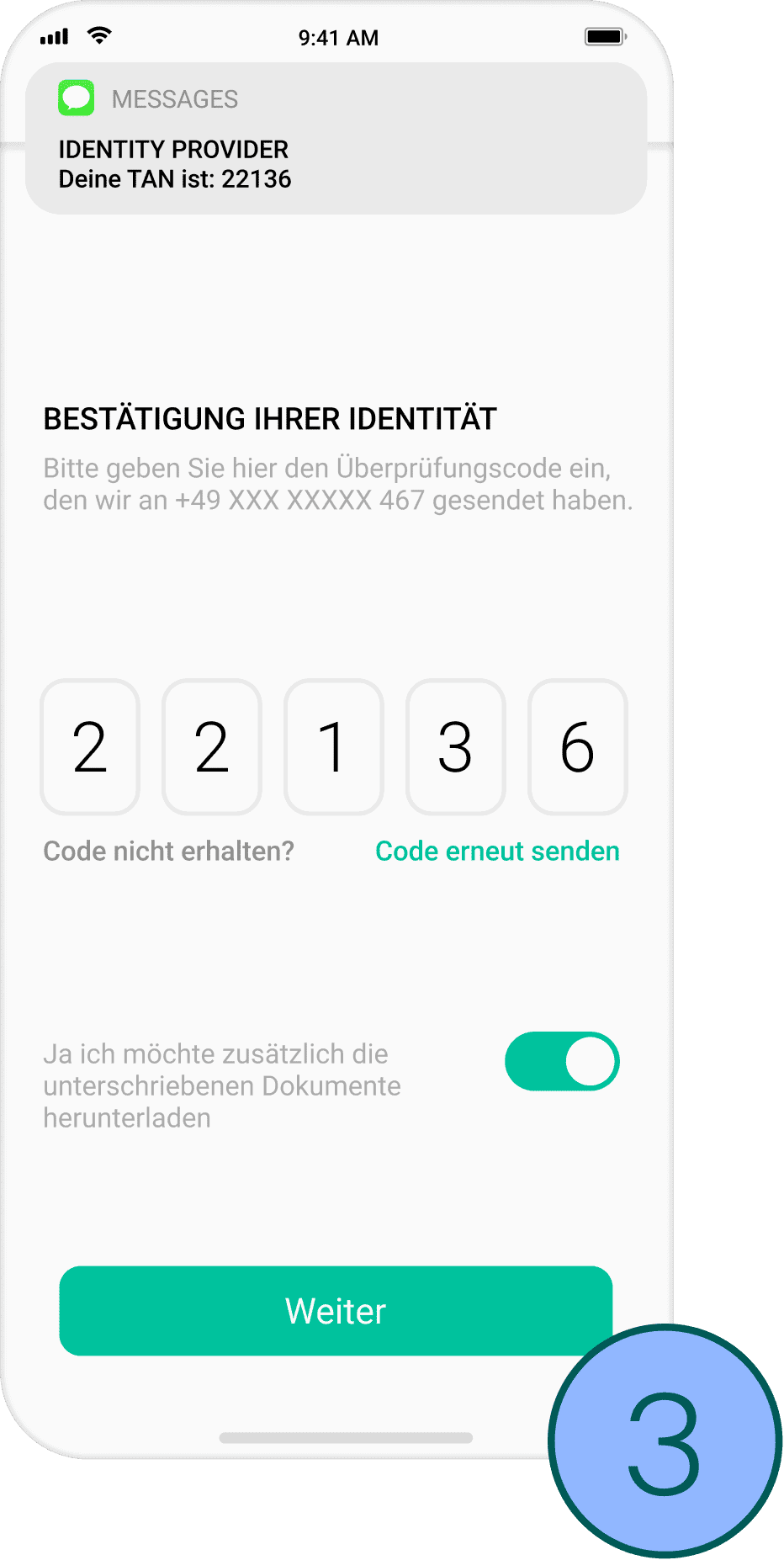

The Verimi Bank-Ident procedure can be carried out as a simple Ident-Check (step 1 only) or as an MLA-compliant identification.

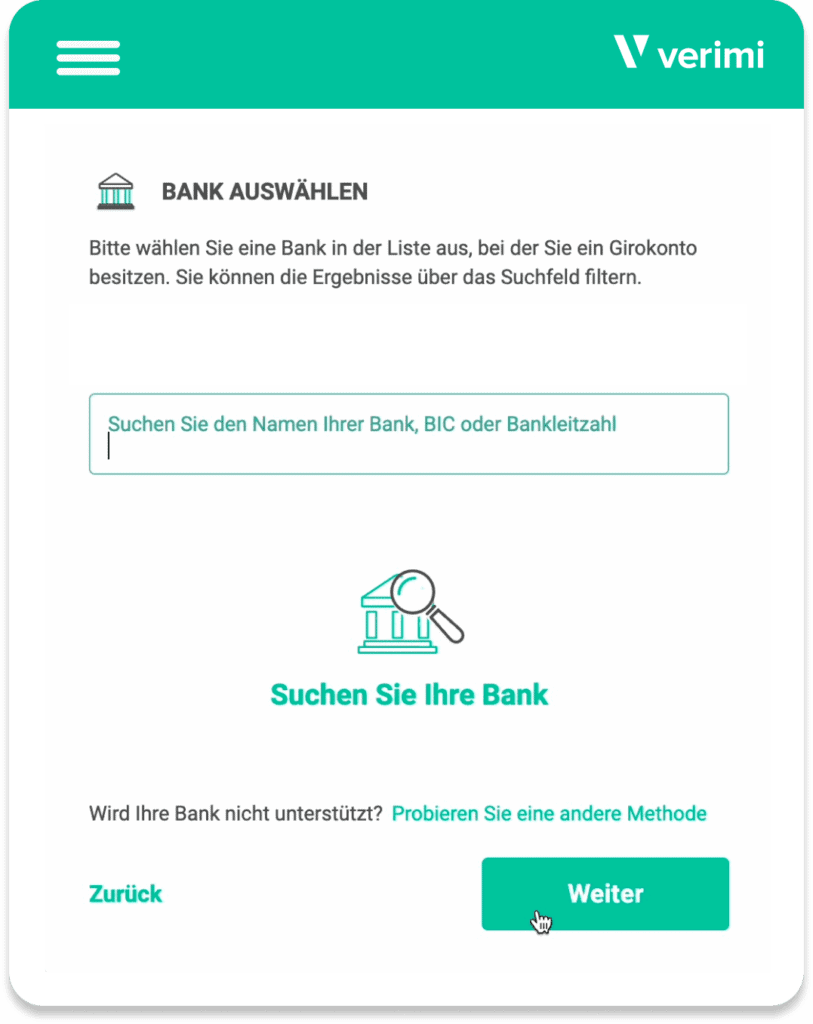

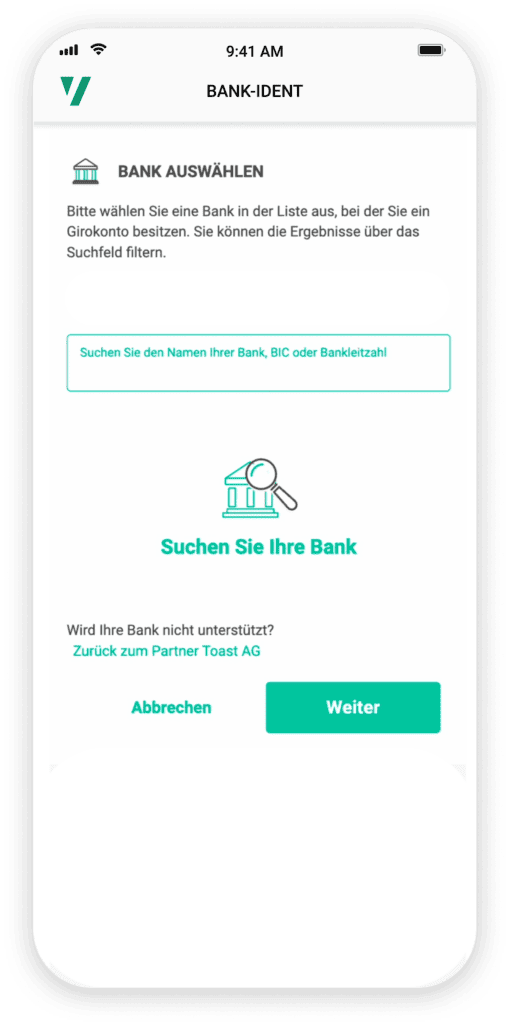

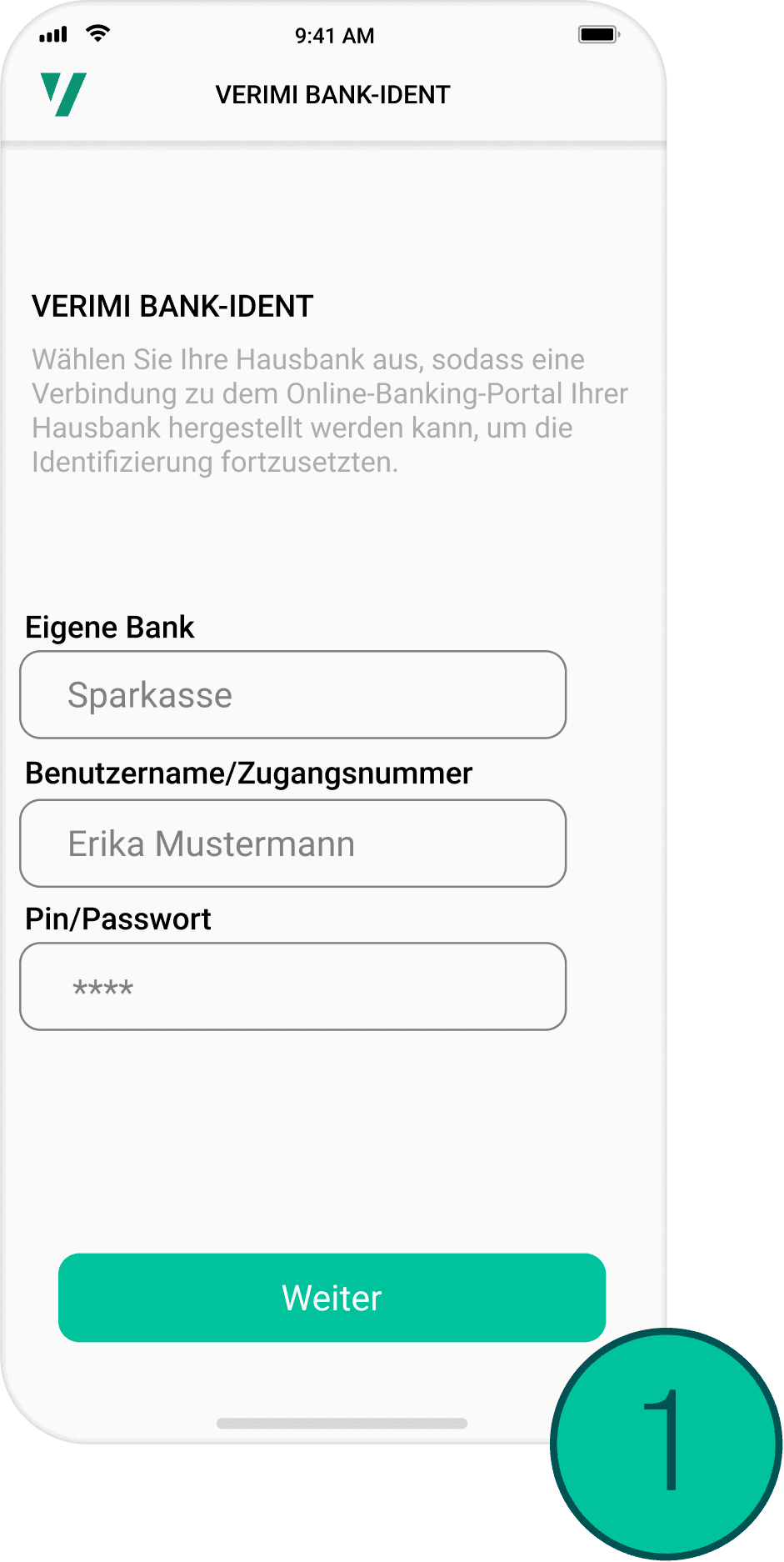

Log in to online banking

Your customers select their own bank and log in to their personal online banking account.

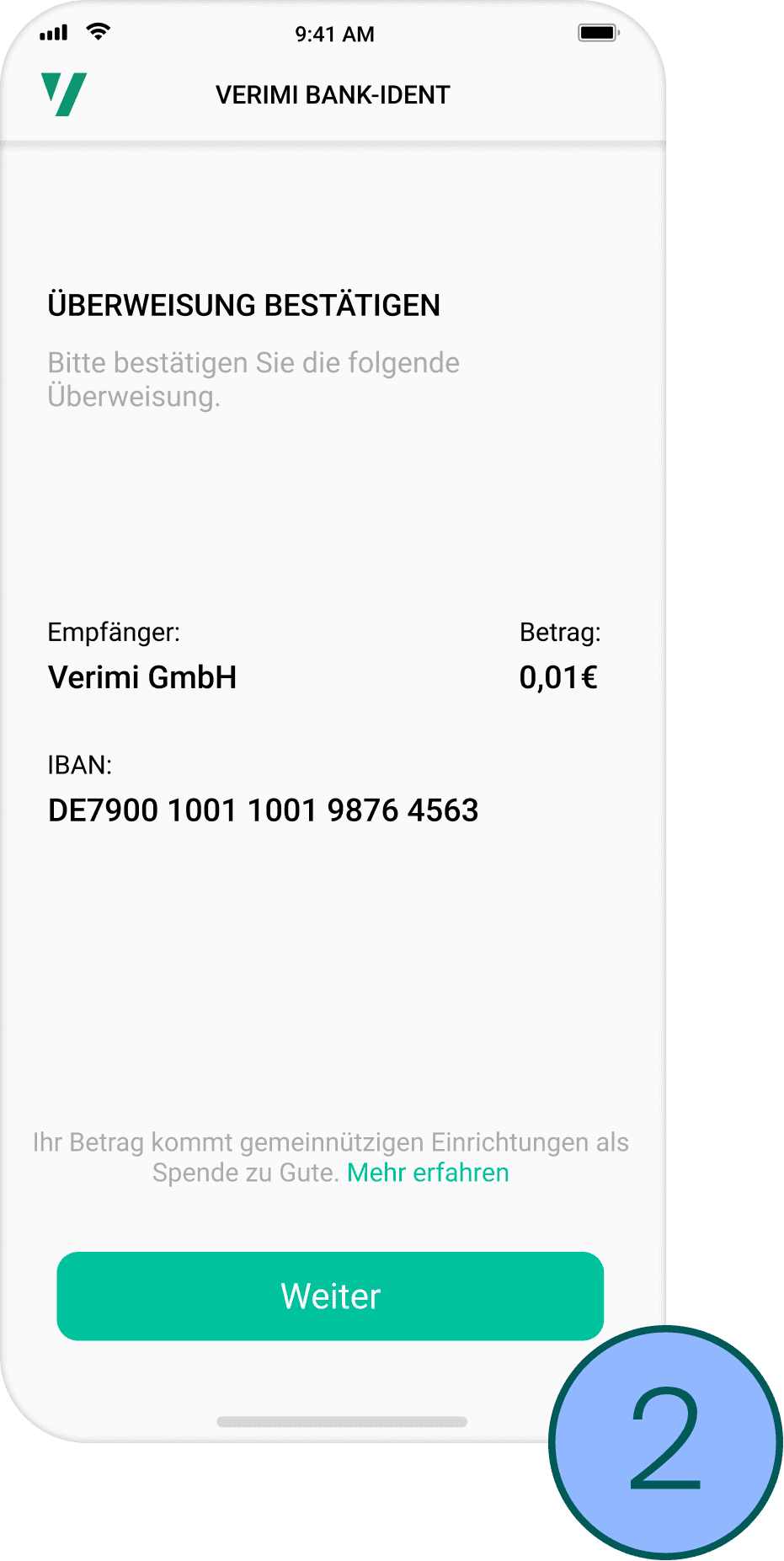

Trigger reference transfer

Your customers initiate a reference transfer of

1 cent and thus confirm the account access.

Sign digitally

The process is confirmed with a qualified electronic signature. This ensures that the identity is compliant with the AMLA.

Secure and convenient for your customers

Offer your customers security and convenience: Verimi Bank-Ident can be used flexibly by your customers at any time and any place – in accordance with the requirements of the German Money Laundering Act (GwG) or without GwG level in unregulated sectors.

Our test procedures provide simple and effective protection against fraud

Data Cross-Reference-Check

Has the correct address been entered?

Identity-Check

Is your customer's identity registered with SCHUFA?

Bank account check

Does SCHUFA have information on the bank account?

Reference transfer

Does the reference transfer work via bank login and TAN?

Two-factor authentication

Is the process confirmed by a second factor (SMS)?

Protection against payment defaults in e-commerce

Protect yourself reliably against fake accounts and fraud in e-commerce! The Verimi Bank-Ident process ensures that the IBAN provided really belongs to the customer and that the transaction is legitimate. Alternatively, other identity verification methods can be used, e.g. simple 1-click identification with the Verimi ID Wallet.

Combine Verimi Bank-Ident with other products

Verimi Sign – Contract signing on the Internet

Combine your customers’ identity verification with Verimi Sign so that they can sign documents digitally, conveniently and legally with a qualified electronic signature (QES).

Verimi Access - Secure login to your customer portal

Your customers use Verimi’s Single Sign-On (SSO) to conveniently log in to your customer portal with just a few clicks.

Other Verimi Ident methods at a glance

Wallet-Ident

Your customers use the data already stored in the Verimi ID Wallet to identify themselves to you, log in, pay and sign. Digitally with just one click.

Photo-Ident

Easily verify the identity of your customers with a photo of their ID documents and a selfie of your customers – for regulated and unregulated sectors.

eID-Ident

MLA-compliant identity verification with the online ID function of the ID card. The identity check is carried out conveniently via smartphone.

Local-Ident

Speed up the identification of your customers on site with Verimi Local-Ident. Local-Ident is a secure and particularly user-friendly process directly at the point of sale.

Comparison of digital identification methods

We have summarised all the important information and comparison criteria

of the Ident methods for you in a PDF.

We help you to find the best identification method

Regulated or unregulated, with or without an agent, fully digital online or on site… there are a few things to consider when choosing the right identification process. Take the test to find out which method suits you best.

How you can use Verimi-Ident in your industry

Our solutions are versatile and can be used for both regulated and non-regulated industries and use cases. Find out more about the possible applications here.

Banking/ Finance

Healthcare sector

Telecommunications

Insurances

Mobility

Betting provider

Public

sector

Holiday & Travel

Online Gaming

Associations & clubs

Talk to our experts

We will be happy to help you find the right solutions and offers for you. Simply fill in the form and we will get back to you as soon as possible.

Kathrin Crawford

Ufuk Irmak

Numerous partners trust Verimi

Verimi Bank-Ident

Customers can use Verimi Bank-Ident to securely identify with their personal bank account. The user identifies themself digitally and Anti-Money Laundering (AML) compliant via login to his bank account.

Comprehensive security

Verimi combines different identification modules for an innovative and secure process. The combination of Payment Initiation Service (PIS) and Qualified Electronic Signature (QES) complies with the requirements of the German Anti-Money Laundering Act. The decisive factor is the verified identity data stored on the bank account. In addition, the process is certified by an independent service provider and accepted by the responsible state supervisory authority.

3-step identification

How it works:

Select bank and login to personal online banking

Trigger reference remittance of 0,01 cents

Confirmation of qualified electronic signature

For a better conversion rate

Available 24/7, independent of agents, fully automated and without physical handling of ID documents. With this innovative process, you design an optimal digital onboarding experience for your customers that leads to a better conversion rate.

Your benefits at a glance

Regulations

Anti-Money Laundering (AML) and eIDAS compliant identification of your customers

Higher conversion

Identification via online banking login without identification document promotes a smaller bounce rate

Security

Our identification modules offer special fraud protection

Easy to integrate

Seamless integration into your individual infrastructure

What's required

- A German bank account

- A device with internet connection and a SIM card: smartphone or tablet

- No Verimi app

Use cases

Use Verimi Bank-Ident for an AML compliant identification of your customers, for example for credit or insurance applications. As part of the identification process, individualised contracts can be signed as well — around the clock, legally valid and digital.

Integrate Verimi Bank-Ident now!

Contact us if you wish to receive more information about Verimi Bank-Ident.

Talk to our experts

We will be happy to help you find the right solutions and offers for you. Simply fill in the form and we will get back to you as soon as possible.

Kathrin Crawford

Ufuk Irmak

Numerous partners trust Verimi

Talk to our experts.

Make an appointment with our team. We will be happy to help you find the right solutions and guide you through the Verimi platform and its functions in a personalised discussion.

Andrej Schleicher

Marcel Riek

Ufuk Irmak

Numerous partners trust Verimi